Messy

Finances

End

Here

Investments | Taxes | Planning

Not your typical advisor

> Genuine Guidance, Not Sales Pitches: We're on your side, not the bank's. No pushy product sales, or hidden commissions, just honest advice that serves you.

> Making the complex simple: Our role is to highlight potential pitfalls and make tough decisions easier, making your financial world less stressful to navigate.

> Strategic Tax and Retirement Guidance: Straight talk on taxes and retirement, minus the mumbo jumbo.

Financial Planning

Imagine facing financial choices with a clear, straightforward guide—no confusion, just easy decisions. That’s our promise: clarity and confidence in every financial move you make.

Tax Planning

Taxes will be your biggest expense over a lifetime. Let's work together to strategically reduce that cost, turning complexity into savings with clear, effective strategies. We do not prepare tax returns.

Investment Management

A low-cost, evidence-based method that maximizes your investments based on proven research.

The Process

1) 15 minute intro call

Hop on a quick phone call to see if we are a good fit, and if we can provide value that exceeds our fee2) Nerding Out

Here we will dig in to the data and ask for pay stubs, workplace benefits, etc to discover how our services could help - No hard sales here, were not selling timeshares :)3) Get started

If we are a good fit and you're ready to work together, we'll get you set up with a plan, action items, and we'll be there to help you along the way.

15 Minute intro call

Join our weekly news briefing

© 2024. Modesto Capital. All rights reserved.

1101 8th Ave Toms River, NJ 08757

Our Investing Approach:

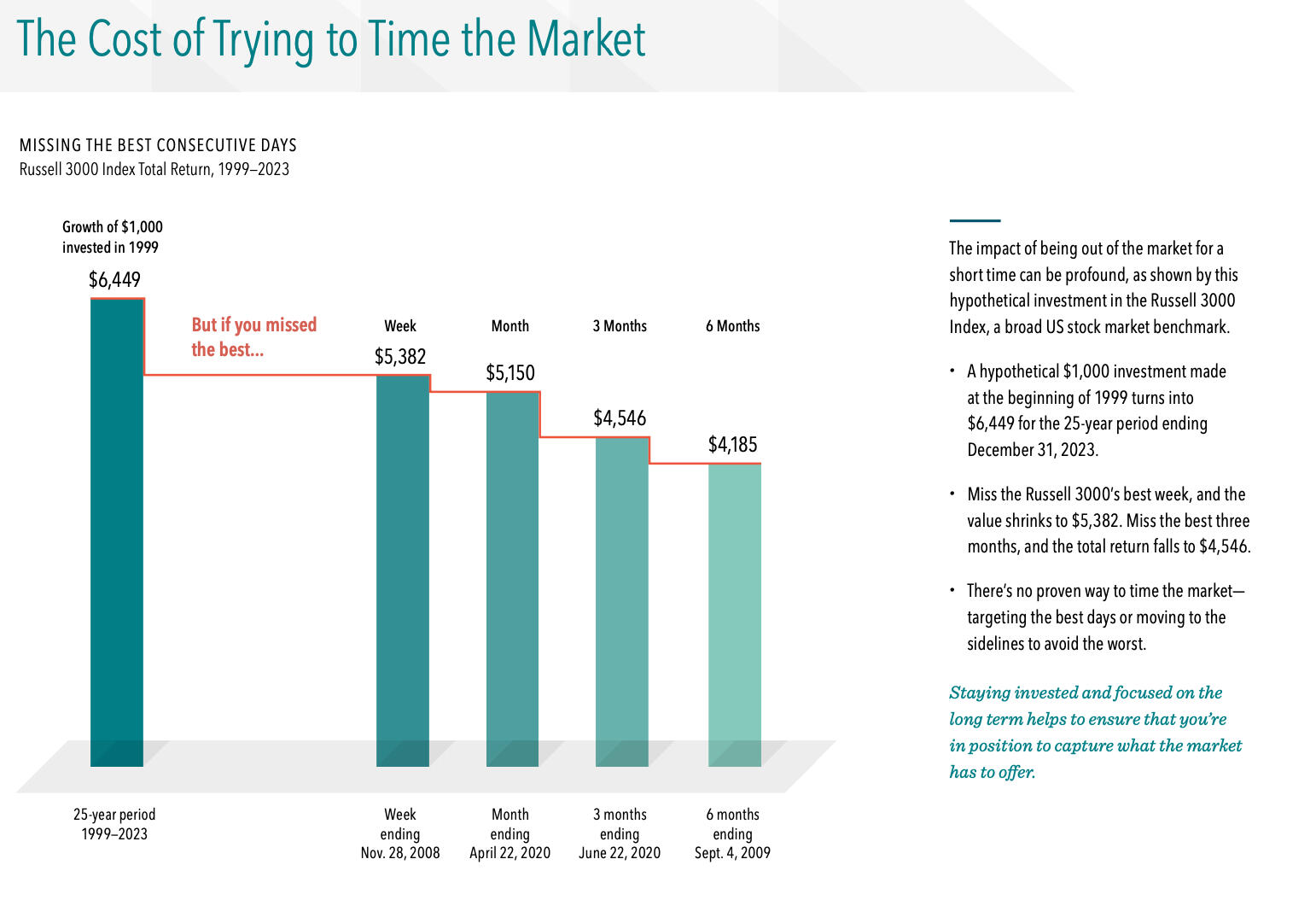

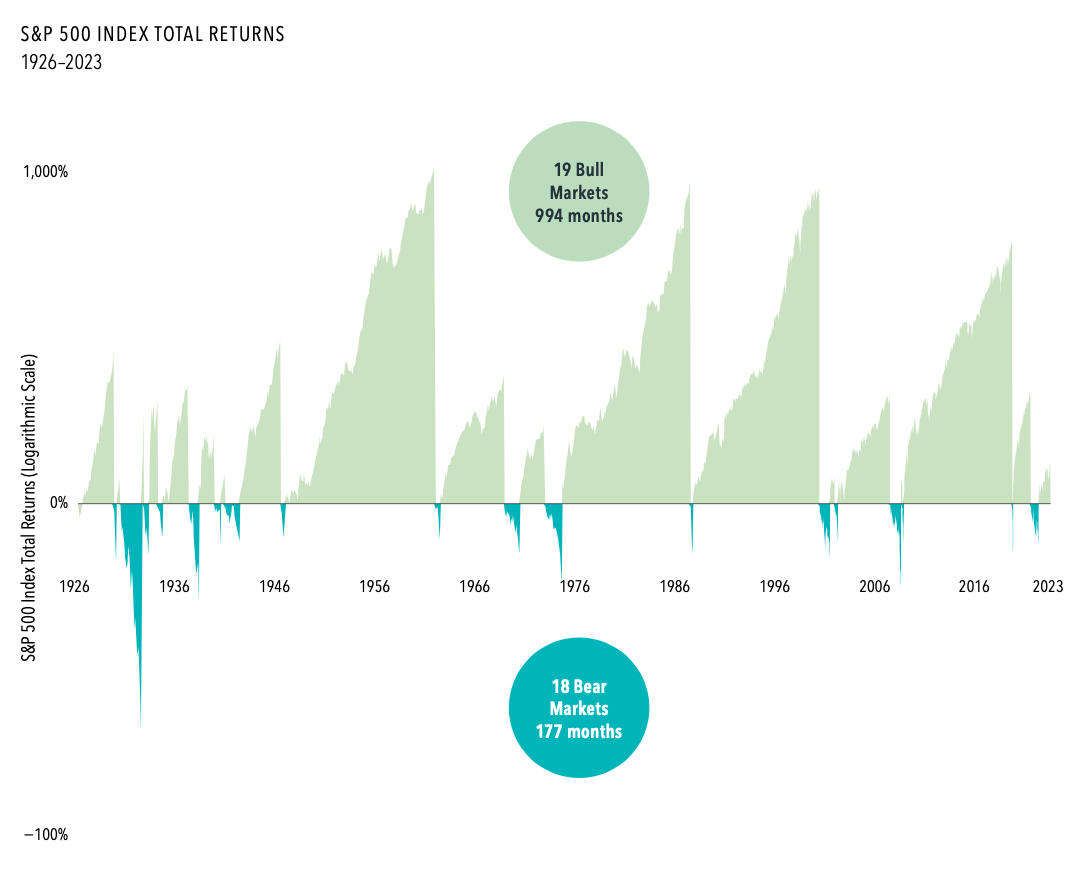

Market Wisdom, Not Timing

Rather than attempting to beat the market, we focus on listening to the market. We believe the knowledge of all market participants is reflected in asset prices.

Risk-Return Optimization

We try and strike a balance between risk and return in every portfolio we create. This ensures your investments are aligned with your financial aspirations.Our portfolios are diversified across US, international, and emerging markets. This approach helps mitigate risk while capturing growth opportunities across the globe.We use a core holding of passive funds for broad market exposure and stability. To enhance potential returns, we strategically tilt towards areas of the market with high expected returns.

Balanced Approach

Carefully considering the benefits of diversification and cost-effectiveness, coupled with the potential for heightened returns, we strategically shape our investment approach.

Funds are held at:

Building Trust Through Regulation: We are a New Jersey-registered Investment Advisor, committed to protecting your financial interests*Your Assets, Safeguarded: All client funds are held at Charles Schwab or Altruist, members of FINRA/SIPCTransparency and Communication: We believe in clear and ongoing communication with our clients.

Our Index Providers

* Registration is not an endorsement by securities regulators and does not mean that the adviser has attained a particular level of skill or ability.

© 2024. Modesto Capital. All rights reserved.

Beyond the Basics: Understanding Our Investment Philosophy

Our Investment Strategy

At Modesto Capital, we believe in a data-driven and long-term approach to investing. Our core strategy is built on two key principles: market efficiency and factor investing.

Why We Believe in Market Efficiency

The Efficient Market Hypothesis (EMH) suggests that financial markets are highly efficient, incorporating all available information into stock prices. This means actively trying to time the market or pick individual winning stocks is unlikely to succeed in the long run.

Passive Investing for Consistent Returns

Based on EMH, we favor passive investing strategies. This involves investing in low-cost index funds that track broad market segments like the S&P 500 or the total stock market. These funds offer:Diversification: By spreading your investment across many companies and sectors, you reduce risk.Lower Costs: Index funds typically have minimal fees compared to actively managed funds.Market Returns: You capture the average market return, which has historically provided strong growth over time.

Enhancing Returns with Factor Investing

While index funds provide a solid foundation, we also incorporate factor investing principles. Factors are characteristics associated with higher risk-adjusted returns, such as:Size: Small-cap stocks have historically outperformed large-cap stocks.Value: Value stocks tend to outperform growth stocks over time.Profitability: Companies with higher profitability tend to outperform those with lower profitability

By strategically allocating your portfolio across these factors, we aim to achieve:Enhanced returns: The potential for higher returns compared to traditional market-cap weighted portfolios.Reduced risk: Diversification across factors helps mitigate losses during down periods in specific asset classes.Investing for the Long Run

Our approach emphasizes patience and a long-term perspective. Factor investing can experience periods of underperformance, but history shows these tend to be temporary. By staying disciplined and focused on your long-term goals, you can weather market fluctuations and achieve your financial objectives.Ready to Discuss Your Investment Strategy?We understand that every investor has unique needs and risk tolerance. We invite you to contact us for a personalized consultation to discuss your investment goals and develop a customized strategy aligned with your financial future.

© 2024. Modesto Capital. All rights reserved.

Services & Pricing

At Modesto Capital, we believe in clear communication and aligning our interests with yours. That's why we offer straightforward fee structures that reflect the value we bring to your investment journey.

Here's a breakdown of our investment pricing:

Pricing

Assets Under Management FeeOur fee structure is simple and transparent. We charge a 1% annual fee based on the Assets Under Management in your investment accounts. This aligns our interests with yours, as our success is tied to the growth of your wealth.

What's Included?

Personalized Investment Strategies: We tailor investment plans to your risk tolerance and financial goals.

Tax-Efficient Planning: We prioritize minimizing your tax burden.

Regular Portfolio Monitoring and Rebalancing: We ensure your portfolio stays aligned with your goals.

Ongoing Communication and Guidance: We keep you informed and involved throughout the process.

Unlimited Access to Our Advisors' Calendars: Need a quick chat? Our advisors are just a calendar invite away. We're here to answer your questions and address your concerns promptly.

Ready to take control of your financial future? Schedule a call with us today to discuss your investment goals and how we can help you achieve them.

© 2024. Modesto Capital. All rights reserved.